855-717-5436

America's Preferred Consumer Protection

Law Firm

Helping businesses and consumers level the playing field, nationwide.

4.7/5 ⭐⭐⭐⭐⭐

Hundreds of happy customers nationwide!

Let’s get started with Merchant Cash Advance debt relief For Your Business

Book a FREE Consultation With Our Team

Book a FREE Consultation

With Our Team

Broad-Based B2B Legal Services

We offer comprehensive B2B legal services, including contracts, disputes, debt negotiation, business formation, and regulatory compliance, helping businesses protect their interests, resolve conflicts, and operate with confidence and legal clarity.

Commercial Law

We provide strategic legal guidance for business transactions, disputes, and regulatory compliance in commercial operations.

Contract Law

We draft, review, and enforce business contracts to protect your interests and prevent future legal issues.

Landlord Disputes

We resolve landlord-tenant conflicts efficiently, ensuring your property rights and lease agreements are legally upheld.

Bankruptcy Law

We help businesses navigate bankruptcy proceedings, protect assets, and explore debt relief or reorganization strategies.

Mortgage Issues

Facing foreclosure or struggling to keep up with payments? We can help protect your home through foreclosure defense, loan modification, or bankruptcy options.

B2B Debt Negotiation and Creditor Claims

We negotiate debt settlements, manage creditor claims, and protect your rights in business-to-business financial disputes.

Consumer Financial Protection Law

We defend businesses facing consumer finance complaints and ensure compliance with federal and state regulations.

Business Formation, Organization, and Counseling

We assist in forming business entities, structuring operations, and providing ongoing legal support for your growth.

Debtors Advocacy Group

Is America’s

Consumer Law Firm

30+ Lawyers

Dedicated Attorneys

25 Services

Broad Consumer Services

1500+ clients

A Single Trusted Point of Contact

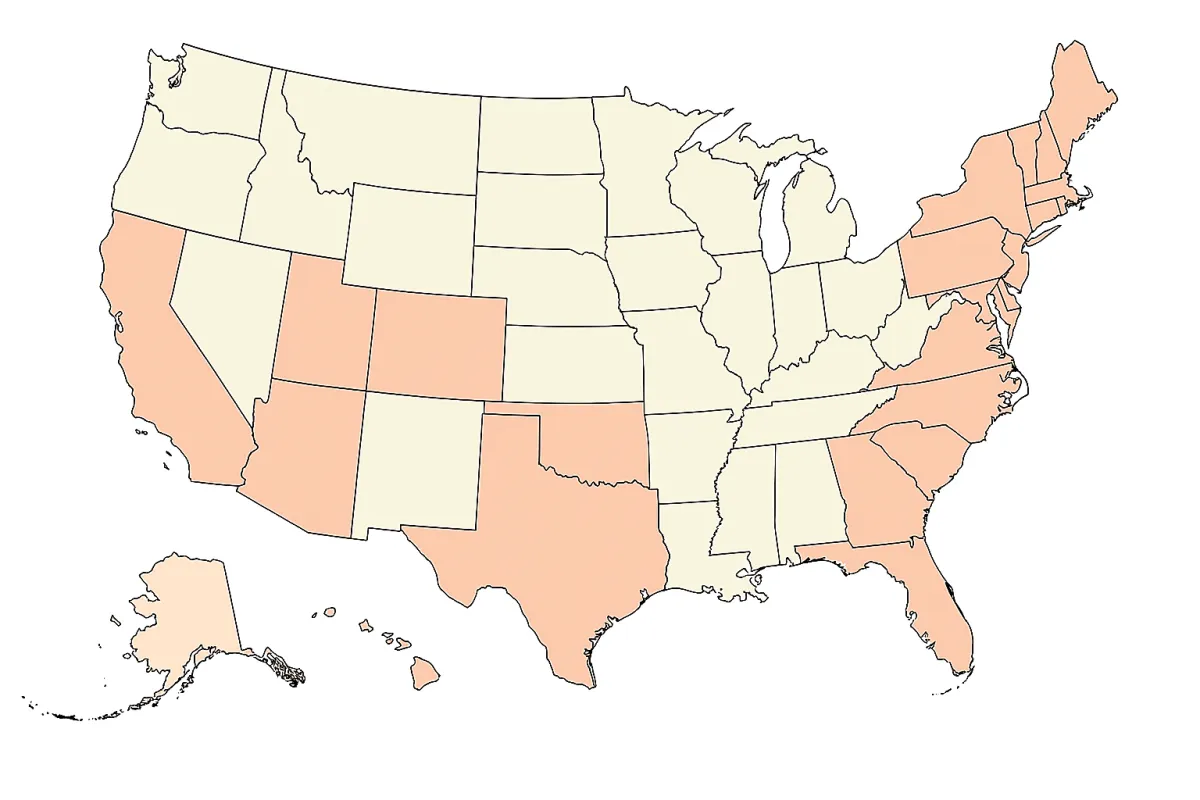

48 States

Nationwide Coverage (Excluding AZ and LA)

Committed to Helping Our

Clients Succeed.

At Debt Advocacy Group, we understand the stress and uncertainty that come with overwhelming debt and the pressure of having taken a merchant cash advance. Our mission is to help individuals and families regain control of their financial future through compassionate, strategic legal support.

Whether you're facing creditor harassment, ucc liens, wage and bank garnishment, or considering bankruptcy, our experienced attorneys are here to guide you every step of the way. We take pride in offering personalized solutions that match your unique situation — not one-size-fits-all advice.

Let us be your advocate in times of financial difficulty. We’re committed to helping you get a fresh start and the peace of mind you deserve.

Free Initial Consultation

Attorneys Licensed in Dozens of States

No Pressure. Just Practical Legal Help.

Areas We Serve

At Debtors Advocacy Group, we have attorneys licensed to practice law in dozens of states, admitted to federal courts in many others, and experienced in a wide range of legal practice areas.

Meet the Team of Lawyers

At Debtors Advocacy Group, we’re more than legal professionals — we’re advocates for your financial future. Our attorneys bring decades of combined experience in bankruptcy law, debt resolution, and consumer protection. We understand the legal system and, more importantly, we understand people.

Each member of our legal team is committed to delivering personalized support, practical strategies, and real results for individuals and families struggling with debt.

THOMAS P. MULDOON, JR.

Tom is the firm's Managing Member and has tried numerous jury trials and hundreds of non-jury matters, arbitrations and mediations.

Tom is in his thirty-fifth year of practice, all of which has been devoted to civil and commercial litigation in a variety of matters. At the request of his clients, Tom has been specially admitted to practice in the courts of Florida, New York and New Jersey on many occasions during his years of practice. Tom also serves as a mediator or arbitrator in personal injury, construction, contract and commercial matters.

Managing Member

Licensed in PA

Teryn Bird

Teryn was born and raised in Utah. She obtained her B.S. Biomedical Engineering from the University of Utah and her Juris Doctorate degree from the S.J. Quinney College of Law. She is a dedicated and experiences trial attorney with all aspects of civil practice, including family law, intellectual property, consumer and merchant debt collection, bankruptcy, and contract law. She is licensed in to practice law the States of Alaska and Utah.

Attorney

UTAH & ALASKA

JOHN E. SHIELDS, JR.

As an experienced trial attorney for over 35 years, John has represented clients in civil and criminal courts throughout New Jersey and Pennsylvania. John also handles real estate transactions, traffic court matters, mediations, arbitrations and municipal court cases. John is Of Counsel to the Firm and has provided his years of experience and guidance to our New Jersey and Pennsylvania clients.

Counsel to the Firm

Maxwell Pafford

Max Pafford grew up in Middle Tennessee. He received his B.A. in Economics from the University of Alabama before earning his Juris Doctorate from Belmont University in 2024. While studying there, his work was chosen for publication in the Belmont Criminal Law Journal. He was admitted to the practice of law in Tennessee in Fall of 2024, where he would practice general civil litigation for one year before gaining admittance to the bar in Pennsylvania in the Fall of 2025. He joined Debtors Advocacy Group in December of 2025.

Attorney

Pennsylvania

HALEY SIMMONEAU

Haley brings over 15 years of experience and a deep understanding of the law to her practice with experience in bankruptcy, business law, debt defense, corporate negotiations, employment matters, loan modifications, and real estate. She is currently licensed in Oklahoma and Texas where she focuses on assisting her clients with all manners of debt work. She received a Bachelor of Science from Austin Peay State University and her Juris Doctorate from the University of Oklahoma School of Law. While attending the University of Oklahoma she participated in the Oxford England Legal Program. She is admitted to practice before the United States District Courts for the Western District of Oklahoma, Northern District of Oklahoma, and the Eastern District of Oklahoma.

Attorney

TEXAS & OKLAHOMA

Murphy Pepper

Murphy Pepper was born and raised in Virginia. He received his B.S. in Commerce at the University of Virginia in 1995 and his Juris Doctorate (magna cum laude) from Duke University in 1998. He practices bankruptcy law, debt defense, and real estate law. He is licensed to practice in the Commonwealth of Virginia.

Attorney

VIRGINIA

Joseph D. Steward

Joseph D. Steward, III was born and raised in Philadelphia and carries the city’s grit and determination into his practice of law. He earned his J.D. from the Thomas R. Kline School of Law, where he developed a strong foundation in advocacy and civil litigation. Today, Joseph represents clients in all aspects of civil litigation, approaching every case with a focus on practical solutions and dedicated client service.

Outside of his practice, Joseph enjoys spending time with his wife and their young son, as well as their two dogs, Ziggy and Prime. Whether in the courtroom or at home, he values integrity, family, and perseverance.

Attorney

CALIFORNIA

LEWIS J. LEVEY

Lewis J. Levey has been an active trial lawyer since 1987 after his graduation from the University of Miami School of Law. He is a member of the Florida bar and an active member of the Dade County Bar. Lew is Past President of the Coral Gables Bar Association and the University of Miami School of Law Alumni Association. He is a member of the Florida Bar, the Federal Bar of the United States District Court for the Southern District of Florida, the Federal Bar of the United States Bankruptcy Court for the Southern District of Florida and is admitted to practice before the United States Court of Appeals for the 11th Circuit. Lew is Past President of the Coral Gables Bar Association and the University of Miami School of Law Alumni Association.

Lew’s practice areas include business & commercial litigation, intellectual property litigation, real estate litigation, judgment enforcement and collections, garnishments, evictions, and replevins.

Attorney

FLORIDA

Latest News

Explore more on how we can help you...

Counting Employees For FMLA Eligibility

The Family and Medical Leave Act (FMLA) provides eligible employees with job-protected leave for qualifying medical and family-related reasons. However, not all employers are covered under the FMLA, and not all employees qualify as a job discrimination lawyer can explain. One key factor in determining coverage is the number of employees an employer has. Understanding...

What Are The Most Common Causes Of Bus Accidents?

Bus accidents are a serious concern for both passengers and pedestrians. They can lead to severe injuries or fatalities, especially when they involve large vehicles carrying many passengers. While every accident is unique, several common causes contribute to bus accidents. Understanding these factors can help raise awareness and promote safer road practices. Driver Fatigue And...

How DUIs Can Impact Your Career

A DUI charge can have far-reaching consequences beyond fines, license suspension, or court-mandated programs. One of the most significant impacts is on your career. Whether you are a first-time offender or have faced charges before, a DUI can affect your employment prospects, professional reputation, and even your ability to maintain certain jobs. Potential Job Loss...

STILL NOT SURE?

Frequently Asked Questions

How do I know if I qualify for Chapter 7 bankruptcy?

You can determine your eligibility for Chapter 7 bankruptcy in Nevada by taking the state’s bankruptcy means test, established by the state’s 2005 Bankruptcy Abuse Prevention and Consumer Protection Act. The test is intended to determine if bankruptcy petitioners have the means to discharge some of their debts through Chapter 13 bankruptcy.

It uses your income, expenses, and the size of your family to calculate whether you have enough disposable income to pay your creditors. However, even if you don’t pass the test, that doesn’t mean you’re disqualified. To know for sure, call now to schedule a consultation with our Las Vegas bankruptcy lawyer.

Can you help me dispute inaccuracies on my credit report?

If you’re unable to get the original creditor to fix its inaccurate submission to your credit report, you have the right to file a complaint. The Resolve Law Group legal team can draft a legal complaint against the Credit Reporting Agency (CRA) and file it following the Fair Credit Reporting Act (FCRA)’s provisions.

We can also investigate the initial debt and determine if it was legitimate, whether you settled it, and whether it was incorrectly reported.Our credit lawyer offers personalized advice for improving your credit score and finances based on your current situation and goals.

I’m being sued for a debt, how can you help?

If legal actions have begun against you, we’re here to help. If you’ve received notice that you’re being sued for a debt, you have the right to legal representation. Your initial debt may have been sold to a debt collection agency that charges excessive fees and exorbitant interest on top of the initial debt. Our collections lawyer can negotiate a settlement for much less than the initial amount or work out a payment arrangement on your behalf.

If you have had a judgment made against you or had your wages garnished, our attorneys may still be able to mitigate this. We may petition the judge to set aside the judgment or ask for more time to contest it if you weren’t aware of the legal action taken against you. Each case is different, reach out to our office today for tailored legal guidance.

What property is exempt in a Chapter 7 bankruptcy filing?

There are bankruptcy exemptions that allow you to keep necessary property, like your vehicle. Often, the exemption is allowed so that you can continue going to work. Federal bankruptcy exemptions are unavailable in California, so you and your Chapter 7 bankruptcy lawyer will need to take advantage of the state exemptions to protect as much of your assets as possible.

In general, when you file Chapter 7 in California, you should be able to keep your house, primary vehicle, retirement and pension benefits, and much of your non-luxury personal property. Working with our bankruptcy lawyer may help you retain more of your property and money while still being protected by Chapter 7 provisions.

If I was scammed, can I sue?

Our consumer protection lawyer can help you advocate for your rights, even if the product or service you spent money on is fraudulent. If the perpetrator is located in California, then there’s a chance you could file a lawsuit against them to recoup your losses. Our legal team can gather evidence of the deceptive practices to build your claim.

However, some professional scammers may live in a foreign country. In these cases, we advise you to turn over all evidence you collected to the proper federal authorities to investigate.

TESTIMONIALS

What Others Are Saying

"It was such a relief to find someone to help"

Thomas and his Team have been professional, kind and helpful in assisting me with navigating my Bankruptcy filing and hearing. They were very patient with my questions throughout the process and helped me to feel at ease. From when I first spoke with Thomas I felt he was very trustworthy and it was such a relief to find someone to help me along this path which can be daunting. Thank you again Thomas and Team DAG! - Roy Wright

"I highly recommend this firm!"

Thomas and John helped me with getting my life back on track financially. Health problems got me behind on creditors and I was going down a dark hole but their team calmed me down and was there to fight back. They are courteous, straightforward and will explain things as they go forward. I highly recommend this firm! - Tory Brown

Disclaimer

Debtors Advocacy Group is a law firm. This site is ATTORNEY ADVERTISING.

WE ARE NOT A DEBT RELIEF AGENCY. We are a law firm based in Pennsylvania.

We help individuals file for bankruptcy relief under the U.S. Bankruptcy Code, if necessary.

Attorneys with Debtors Advocacy Group are licensed to practice in various jurisdictions. The firm may also affiliate with or refer potential clients to independent law firms located throughout the United States to ensure that proper legal representation is provided where needed. We may also refer matters to attorneys in other states if necessary.

Choosing an attorney is an important decision and should not be based solely on advertisements, testimonials, or content found on this or any other website.

No attorney-client relationship is formed by submitting information through this site or by calling the phone number listed. An attorney-client relationship is only established after a signed agreement is in place between you and our firm.

In some states, we may not have a physical office, and consultations may be conducted virtually.

Nothing on this website should be interpreted as legal advice specific to any individual situation. All information provided is for general informational and educational purposes only, and should not be relied upon without consulting a licensed attorney. Use of this site and the information provided is at your own risk.

Past results do not guarantee future outcomes. Any testimonials or endorsements on this site are not promises, warranties, or predictions about your legal matter.

Contingency fees refer only to fees charged by attorneys for legal services. These may not be allowed in all types of cases, and litigation costs may be separate unless agreed upon in advance.

Statements such as "No fee unless you win" or "We only get paid if we recover for you"

refer to attorney fees and do not include all potential litigation costs, court fees, or expenses, unless otherwise specified in writing.

Attorney Thomas P. Muldoon Jr., 600 W. Germantown Pike, Suite 400,

Plymouth Meeting, PA 19462 , is responsible for the content of this website.

For more information about how we handle personal information, please refer to our

© 2025 Debtors Advocacy Group. All rights reserved.

Phone Numbers

New Clients

855-717-5436

Email

Addresses

Corporate Headquarters

600 W. Germantown Pike,

Suite 400,

Plymouth Meeting, PA 19462